Paying Now vs. Paying As You Go

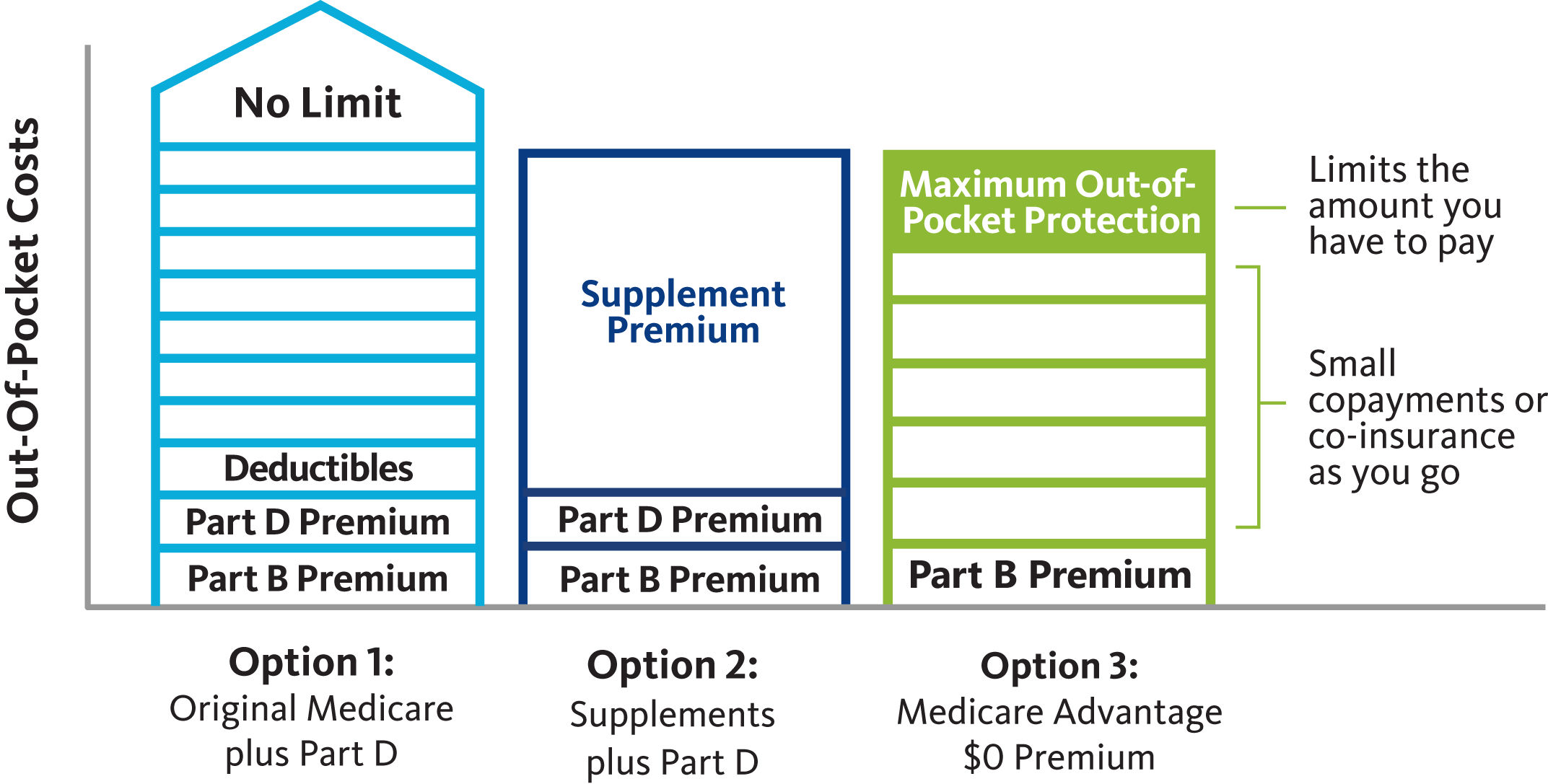

What you pay out of your own pocket and when you pay it depends on which coverage option you choose.

For example, if you choose to add a Medicare supplement to Original Medicare, you’re paying upfront through a monthly premium regardless of whether you see the doctor or go into the hospital.

With Original Medicare, you “pay as you go” by paying 20 percent coinsurance. If you need more extensive medical care however, there’s no limit on what you’ll have to pay out of your own pocket each year.

Many Medicare Advantage plans offer $0 premium plans where you “pay as you go” through small copays or coinsurance amounts and only pay for the care you use. The most important thing to note about a Medicare Advantage plan is that, unlike Original Medicare, it also offers an added layer of protection by limiting the amount you pay out of pocket for covered services each year. That way, you’re covered throughout the year, and your savings and retirement are protected should a serious illness or injury occur.

Interested in Learning More About a

BayCarePlus Medicare Advantage (HMO) Plan?

Request Your FREE Decision Guide

Download your FREE Medicare Advantage Decision Guide or request a copy by mail.

Attend a FREE Medicare seminar

Learn more about BayCarePlus plans at a FREE live seminar or webinar.

Schedule a Personal Consultation

Get your questions answered in a virtual or in-person appointment with a BayCarePlus advisor.

Talk With a Licensed Medicare Advisor

Discuss your options with a licensed Medicare advisor.