New to Medicare?

Choose the Right Coverage for You

If you’re new to Medicare and aren’t sure where to start, you’re not alone. Most people just starting out often find Medicare to be a bit confusing. The good news is, what makes Medicare confusing also makes it great. You have a lot of coverage options to choose from, and you get to pick the one that works best for you. To pick that perfect plan, it’s best to start by learning about the basics of Medicare, and end with taking a closer look at which options really protect your health—and your savings.

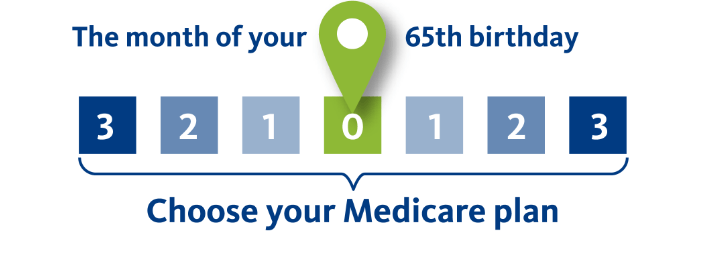

Enrolling in Medicare

When you first become eligible for Medicare, you have a seven month window to enroll that starts three months before your 65th birthday and ends three months after. In the Medicare world, this is called your Initial Enrollment Period, or IEP. During your IEP, you can enroll in Parts A and B and sign up for a Part D plan or a Medicare Advantage Plan.

Medicare Basics: Original Medicare

To start, let’s take a look at Original Medicare, or Parts A and B. Part A is known as hospital insurance, and Part B is known as medical insurance. Together, Parts A and B cover around 80 percent of your medical costs. This leaves you responsible for the remaining 20 percent, and 100 percent of the cost of prescription drugs. You’re also 100 percent responsible for extra benefits like dental and vision. That’s why most people who enroll in Medicare also choose to add additional coverage to help cover what Original Medicare doesn't. There are three common coverage options that we’ll explain below.

Option 1: Add a Part D Plan to Original Medicare

To pick up where Original Medicare leaves off, one option is to purchase a private stand-alone Part D prescription drug plan. These plans are offered by private insurance companies, and the monthly premium for these plans can vary based on how much they cover. Though this option will help cover some of the cost of prescriptions, it still leaves you exposed for the 20 percent of medical costs that Original Medicare doesn’t cover.

Option 2: Add a Part D Plan and a Supplement to Original Medicare

To cover the 20 percent medical costs that Original Medicare doesn’t cover, as well as prescription drugs, some people purchase a Part D plan and a Medicare supplement. Supplements can be expensive though, and you’ll be paying multiple premiums to multiple companies each month.

Option 3: Join a Medicare Advantage Plan

For an “all-in-one” plan that offers comprehensive coverage, many choose a Medicare Advantage plan. These plans cover all the things Original Medicare covers, plus the 20 percent of medical costs that it doesn’t. In addition, many Medicare Advantage plans include Part D prescription drug coverage and valuable extras like dental and vision benefits at no extra cost.

Also, some Medicare Advantage plans, like BayCarePlus (HMO), offer $0 premiums and low copays. They also include a built-in “safety net” that puts a limit on the amount you’ll have to pay out of your own pocket each year.

Protecting Your Finances

Which Medicare coverage option you choose directly impacts the amount you pay out of your own pocket and when you have to pay it. To explain this, many use a “pay now” vs. “pay as you go” analogy. The option you choose also plays a big part in your overall financial risk, because certain options protect your savings more than others.

Interested in Learning More About a

BayCarePlus Medicare Advantage (HMO) Plan?

Request Your FREE Decision Guide

Download your FREE Medicare Advantage Decision Guide or request a copy by mail.

Attend a FREE Medicare seminar

Learn more about BayCarePlus plans at a FREE live seminar or webinar.

Schedule a Personal Consultation

Get your questions answered in a virtual or in-person appointment with a BayCarePlus advisor.

Talk With a Licensed Medicare Advisor

Discuss your options with a licensed Medicare advisor.